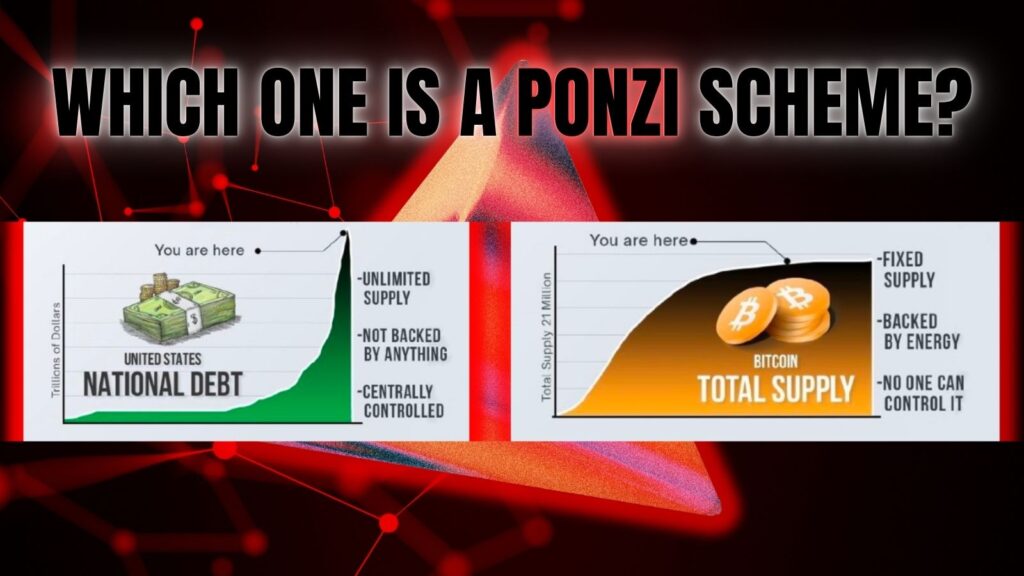

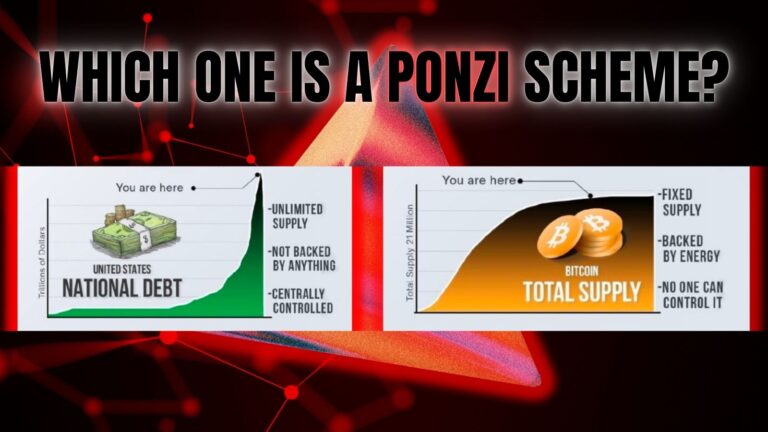

TL;DR: The article delves into the controversial claim that the U.S. dollar, and by extension all fiat currencies, operate like Ponzi schemes. It argues that the U.S. government finances its deficit by continuously taking on new debt to pay off older debts, akin to the mechanism of a Ponzi scheme. It also makes a case for Bitcoin as a more stable store of value.

What Is a Ponzi Scheme?

Per the definition provided by Wikipedia, a Ponzi scheme is “a form of fraud which lures investors and pays profits to earlier investors by using funds obtained from more recent investors.” This foundational concept has disturbing similarities to how modern economies, particularly the U.S., manage their debt and currency issuance.

The Debt-Driven U.S. Economy

The U.S. government has mastered the art of running on a deficit. Year after year, it hemorrhages money, perpetually taking on new debt to cover existing obligations. The cycle of borrowing is relentless, resembling the operation of a Ponzi scheme: new debt finances the old. Notably, the government has shown no intention of retiring this ever-growing mountain of debt. In fact, tax cuts passed recently are expected to drive the deficit upwards by an estimated $1.071 trillion over the next decade.

Warnings from the Financial Elite

Seth Klarman, a notable investor, has recently cautioned that America’s debt addiction will inevitably lead to a “skeptical debt market.” There will come a time when lenders might hesitate to continue extending credit at affordable rates, precipitating a possible financial crisis.

A Historical Debt Pandemic

What’s astonishing is that the U.S. has operated at an average daily deficit of about $248 million since its founding in 1776. The math points to a startling reality — America has lived beyond its means for 88,345 days.

Fiat Currency: A Confidence Game

Initially tied to a gold standard, the U.S. dollar has morphed into a mere symbol of trust, devoid of intrinsic value. This enables the government not only to amass debt but also to create more currency out of thin air.

A Global Phenomenon

The U.S. is not an isolated case. Other countries also run similar systems. All global currencies seem to perpetually lose value, especially when compared to gold, a store of value cherished for over 2,500 years.

Bitcoin: The New Gold?

If gold has been a consistent store of value, Bitcoin is an even more robust one. Often termed ‘digital gold,’ it is increasingly being recognized as a more stable and less manipulable asset. It’s no surprise that many are ‘long Bitcoin,’ not just as an investment but as a critique of the existing financial systems.

Anecdotal Evidences and Elevator Conversations

These ideas aren’t just theories or thought experiments. People are actively discussing the U.S. dollar’s viability. These discussions reveal a growing awareness and skepticism about the sustainable nature of the world’s financial systems.

The Eternal Cycle of Debt

This debt-repayment cycle is not exclusive to the United States; other governments globally engage in the same financial ballet. Countries like India also operate on a deficit, borrowing to bridge the gap between expenses and revenues. Yet, when a government engages in such practices, it’s euphemistically termed “deficit financing,” shielding it from the Ponzi label and its criminal implications.

Conclusion: A New Monetary Paradigm

Amidst the labyrinth of economic uncertainties, the time is ripe for a more stable and decentralized store of value. While governments and their currencies continue to play this complex game of financial musical chairs, there’s a digital asset waiting in the wings — ready to bring in a sense of balance and immunity to manipulations. Don’t let your future be at the mercy of a system built on shifting sands. Opt for a foundation of cryptographic security and decentralized trust. Because in a world of fragile castles made of debt, it’s the strongest fortress that survives.

Thank you for reading “The Illusion of the Dollar: Is Fiat Currency the World’s Grandest Ponzi Scheme?“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources

- Wikipedia — Definition of Ponzi Scheme

- U.S. Government Financial Reports

- Statements from Seth Klarman

- Historical Data on U.S. Economy and Debt

- Comparisons between Gold and Bitcoin

- Anecdotal Conversations and Interviews on the U.S. Dollar and Financial Systems

Recent Stories

The Illusion of the Dollar: Is Fiat Currency the World’s Grandest Ponzi Scheme?

The vanguard of global commerce has been swept up in a wave of change, as over 62% of Fortune 100 companies…

Reclaiming Trust and Autonomy in Governance: The Role of Blockchain and Bitcoin Amidst a Global Wave of Discontent

As hashtags like #WEWILLNOTCOMPLY trend globally, it signals more than just ephemeral social media activity….

Disruptive Waves: How AI is Changing the Financial Landscape

TL;DR: Artificial Intelligence (AI) is making significant strides in reshaping the future of finance…

Today’s Highlights From Within the Crypto World

TL;DR: This article delves into key developments in the crypto world, covering legal, regulatory, and…

No posts found