TL;DR: Understanding the multifaceted layers of scams, especially in the cryptocurrency sphere, is crucial for financial well-being. This article delves into the importance of communication, education, and personal responsibility in this space, and it challenges the narrative that all risks in cryptocurrency are a result of its inherent nature. In a realm where autonomy is key, taking control of one’s financial destiny becomes an act of philosophical resonance.

$16 Million in Cryptocurrency Vanished Due to Hacks This August

The emergence of cryptocurrency has given rise to a gamut of financial opportunities. However, where there is opportunity, there also lies a breeding ground for nefarious activities. A dynamic landscape filled with promise is equally rife with scams, and those scams are increasingly elaborate, involving a blend of psychology and technology. What can one do to navigate this quicksand?

Trust-Building in an Ecosystem of Skepticism

Scammers employ social engineering to exploit trust. They spend countless hours on phone calls and messaging, mimicking genuine human interaction to manipulate their victims. Reputed cryptocurrency platforms like CoinSpot are countering this by simply talking to their customers. The philosophy is clear: inject the element of human connection, the real one this time, to break the false layer of trust established by scammers. This isn’t just about due diligence; it’s about humanizing an often impersonal space to protect those who participate in it.

The Education Imperative

The landscape of scams isn’t limited to the realm of cryptocurrencies. It’s a systemic issue that stretches its tentacles into various other sectors, from banking to social media. As Jason Titman of Swyftx points out, education is vital in making people scam-resistant. The underlying asset or technology might change, but the tactics employed by scammers often remain constant. Informing customers and the public at large is an essential step to stem the tide of an escalating problem.

Sovereignty Through Private Keys

“No keys, no cheese,” as the adage should probably go in the crypto universe. The concept here is straightforward. Whoever controls the private keys controls the funds stored in a wallet. When using a custodial service like some centralized exchanges, users are essentially relinquishing control over their funds. In a world where phrases like “financial freedom” are generously tossed around, it’s ironic that many willingly yield this autonomy to centralized custodians. With freedom comes responsibility, and in this case, the responsibility of managing private keys lies squarely with the individual. This is where hardware wallets and non-custodial options rise as the unsung heroes. They don’t just provide security; they enshrine the essence of what financial sovereignty should be in the crypto era.

Taking Back the Narrative: It’s Not Just Crypto’s Fault

The ease with which the narrative gets tilted against cryptocurrency is perplexing. Crypto scams are not merely a result of the technology but a symptom of broader systemic issues. This financial landscape doesn’t operate in a vacuum. By engaging with regulators and partnering with other sectors, the crypto industry is actively working to shift the paradigm. No longer can it be badgered into submission, unfairly blamed for issues it shares with traditional financial systems.

The Spirit of Self-Reliance

In a world increasingly inclined towards collective responsibility, cryptocurrencies provide a counter-narrative. They offer the promise of self-reliance, individualism, and financial sovereignty in a way no other asset class does. Embracing this technology isn’t just about making smart financial decisions. It’s about endorsing a philosophy that celebrates autonomy, personal responsibility, and the sheer invigorating power of taking control of one’s financial destiny. To yield this control to scams and scammers is not just a financial loss but a surrender of these ideals.

Thank you for reading “Navigating the $16M Quicksand: How Crypto Scams and Hacks Devoured Millions in August“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources

- $16M in crypto lost to hacks in August — Report — Cointelegraph

- $16M in Crypto Vanishes to Exploits in August

- 7 Common Crypto Scams and How to Avoid Them

- How To Avoid Crypto Scams

Recent Stories

Navigating the $16M Quicksand: How Crypto Scams and Hacks Devoured Millions in August

The vanguard of global commerce has been swept up in a wave of change, as over 62% of Fortune 100 companies…

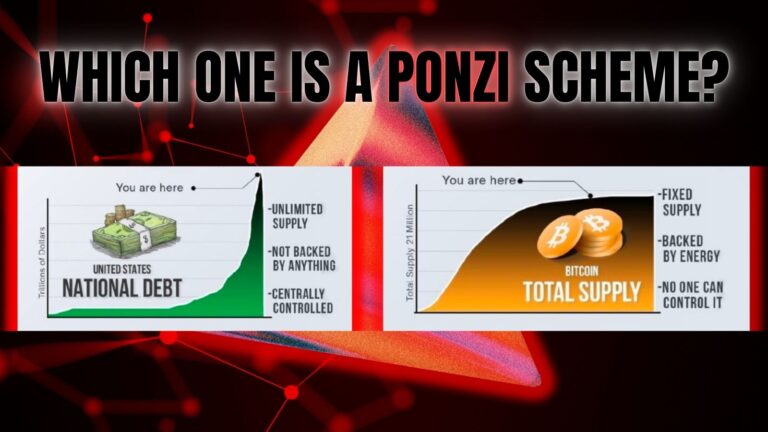

The Illusion of the Dollar: Is Fiat Currency the World’s Grandest Ponzi Scheme?

TL;DR: The article delves into the controversial claim that the U.S. dollar, and by extension all fiat…

Reclaiming Trust and Autonomy in Governance: The Role of Blockchain and Bitcoin Amidst a Global Wave of Discontent

As hashtags like #WEWILLNOTCOMPLY trend globally, it signals more than just ephemeral social media activity….

Disruptive Waves: How AI is Changing the Financial Landscape

TL;DR: Artificial Intelligence (AI) is making significant strides in reshaping the future of finance…

No posts found