TL;DR: The article discusses the SEC’s delayed decisions on Bitcoin ETF approvals and raises questions about insider knowledge. It also delves into the financial disparities between the world’s wealthiest and the rest of the population. Additionally, the article explores the declining purchasing power of currency over time due to political manipulation. It suggests that adopting a Bitcoin strategy could be a solution for nation-states to preserve value.

Subtle Games on Wall Street

Let’s cut to the chase. The U.S. Securities and Exchange Commission (SEC) has yet again postponed its decision on the approval of several spot Bitcoin ETFs. Names like Blackrock, Wisdom Tree, Invesco, Galaxy, and Valkyrie now have to wait another 45 days to know their fate. The question that arises, and it’s a troubling one, is who had prior knowledge of this delay? Sell-offs in the Bitcoin market just before such announcements can be a telltale sign of insider information.

The ‘Fishiness’ of Preemptive Action

‘Selling the news’ is a well-known investment tactic. But when the news is sold before it even makes the headlines, the situation gets murky. Could it be that there are those with such privileged access to information that they can execute financial maneuvers before the rest of the market is even aware?

Financial Disparities: The Striking Imbalance of Wealth

The Magnates and the Masses

What’s equally disturbing is the concentration of wealth among a very small number of people. Believe it or not, around 20 individuals hold as much wealth as the rest of the world’s population combined. Is it pure coincidence, or could these power players possibly have some form of advanced knowledge that gives them an edge in the financial markets?

Currency Devaluation: The Silent Thief

The Fading Value of Paper Money

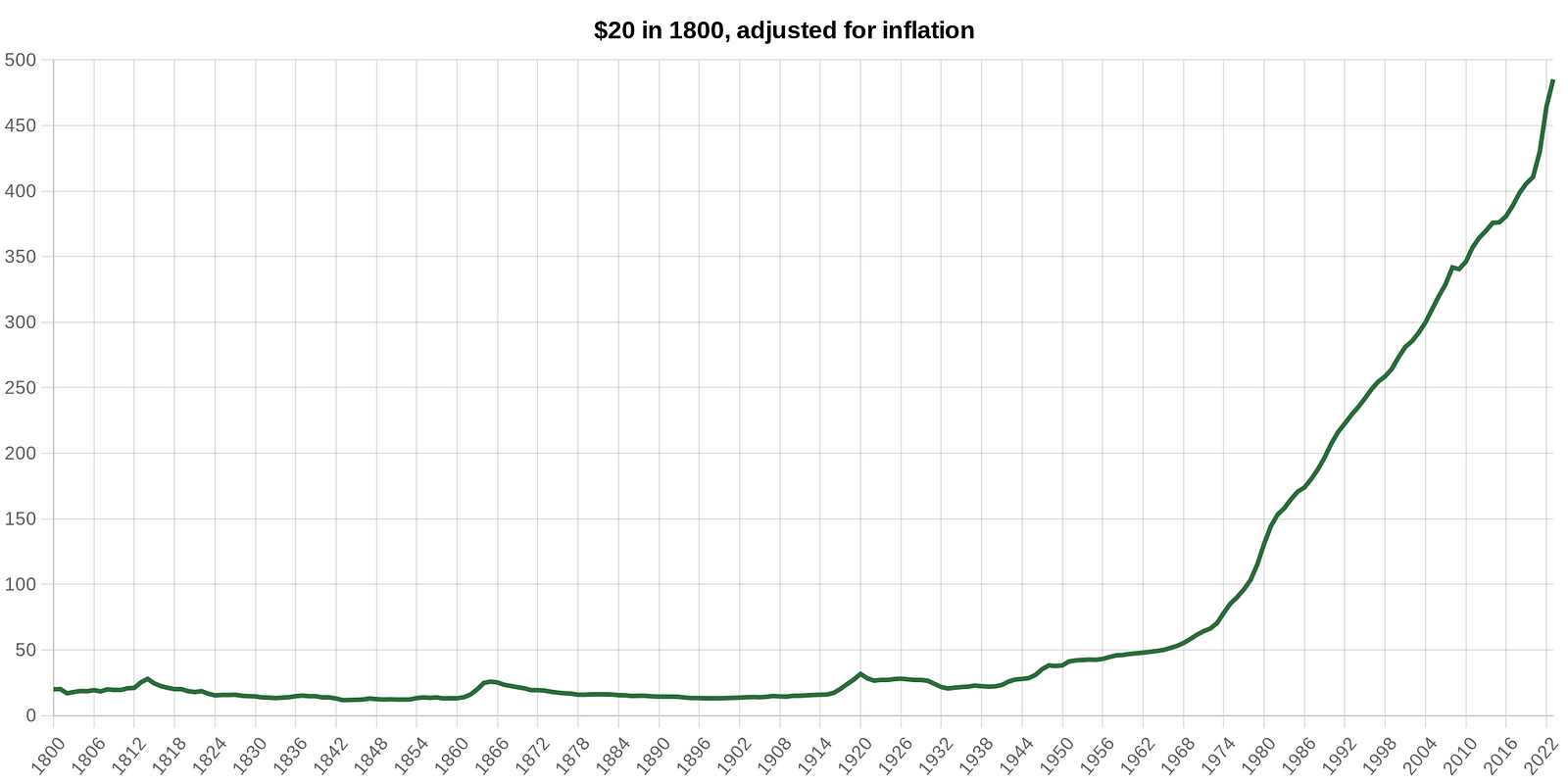

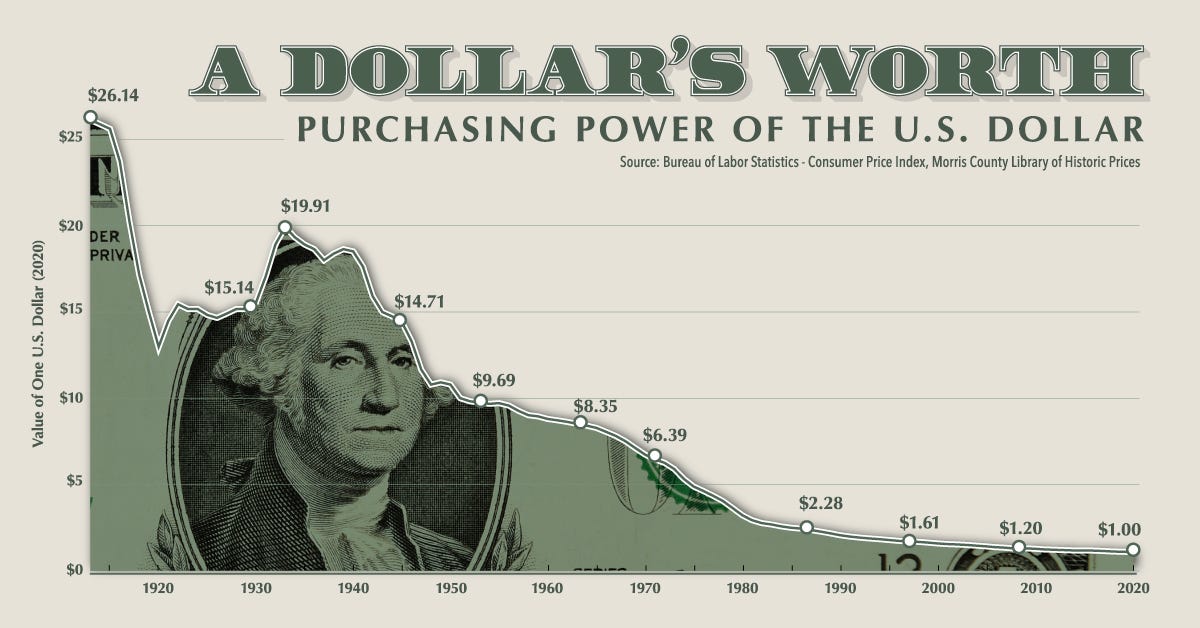

Here’s something to ponder: a $100 bill in 1998 would have less purchasing power than a $20 bill in the 1960s. Essentially, anyone who stashed their cash in a physical safe for decades would have experienced an 80% erosion in value. Unfortunately, no vault can protect your wealth from the inflationary policies set by the political elite who control the monetary supply.

The Cost of Complacency

What used to cost $20 in 1998, now costs around $120. The erosion of value is not subtle; it’s glaringly evident. And it’s a message to all: storing wealth in traditional forms (fiat) is increasingly becoming a losing strategy.

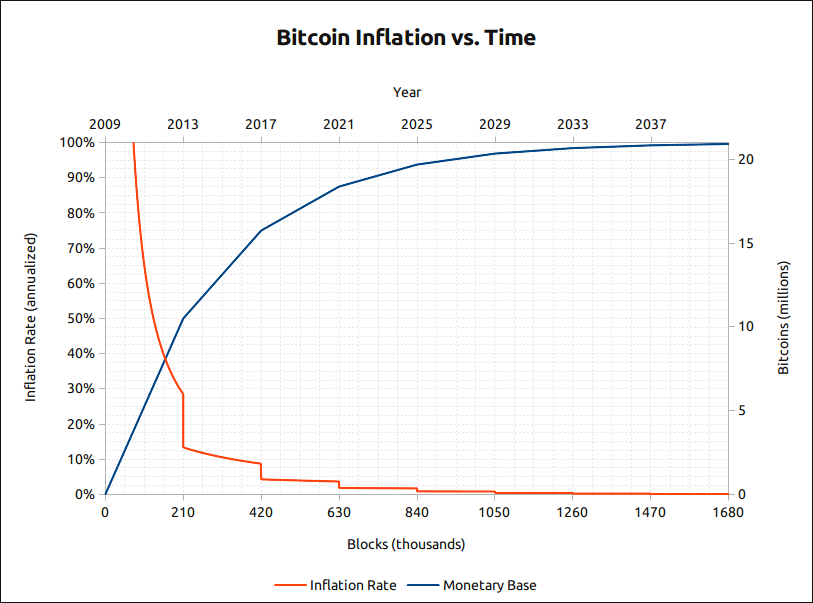

A Wake-up Call for Nation-States: The Bitcoin Strategy

As we move forward, it becomes apparent that the existing financial system, marred by lack of transparency and subjected to political whims, is unsustainable. The options are dwindling, and the endgame might be nearer than we think. Nation-states need to understand that adopting a Bitcoin strategy could be their only lifeline. The digital asset serves as a dual-edged sword in the financial landscape: not only does it provide a robust form of financial sovereignty, safeguarding individual autonomy, but it also democratizes economic opportunities by leveling the playing field. Most critically, it mitigates the risk of covert manipulations, such as inflation, that have long plagued traditional financial systems.

In the quest for financial independence and security, it’s vital to remember that true freedom lies in the hands of the individual, not those who wield temporary power through centralized systems. Decentralized digital currencies offer an alternative that respects the autonomy of the individual, while also being inherently resistant to the abuses of a centralized financial system. Make no mistake, the rebellion against traditional financial constructs is already in motion; choose your alliances wisely.

Thank you for reading “Inside Information or Coincidence? The Suspicious Timing of Bitcoin Sell-Offs Before ETF Delays“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources

- U.S. Securities and Exchange Commission announcements on Bitcoin ETF delays

- Global Wealth Reports

- Historical inflation data

- Bitcoin Market Analysis Reports

Recent Stories

Inside Information or Coincidence? The Suspicious Timing of Bitcoin Sell-Offs Before ETF Delays

The vanguard of global commerce has been swept up in a wave of change, as over 62% of Fortune 100 companies…

A Transformative Month for Crypto: August 2023’s Milestones

TL;DR: August 2023 has been a watershed month for the crypto industry, replete with significant events…

Why Opposing CBDCs Means Supporting Bitcoin

TL;DR: Central bank digital currencies represent centralized control over money and surveillance of transactions….

Navigating the $16M Quicksand: How Crypto Scams and Hacks Devoured Millions in August

TL;DR: Understanding the multifaceted layers of scams, especially in the cryptocurrency sphere, is crucial…

No posts found