TL;DR

Quantum computing advancements, while impressive, are far from being capable of compromising Bitcoin. Breaking Bitcoin’s encryption would require quantum computers thousands—if not millions—of times more powerful than today’s systems. Moreover, Bitcoin is designed to adapt, with a decentralized governance structure that ensures no single entity can force changes. This resilience, combined with existing quantum-resistant cryptographic solutions, makes Bitcoin a robust and secure system, well-prepared for the future.

Quantum Computing: A Threat to Bitcoin?

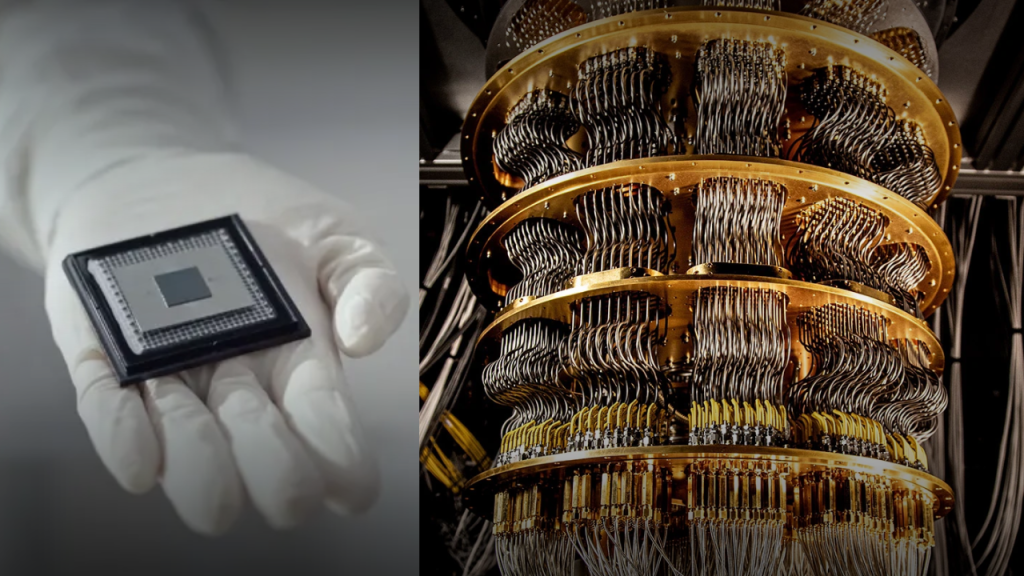

In recent years, quantum computing has made headlines with remarkable technological advancements. The latest example, Google’s Willow chip, showcases significant progress in the quantum space with 105 qubits. This development has led to sensational claims that Bitcoin’s security is at risk, with fears of quantum computers breaking its encryption and compromising user funds.

However, such claims fail to grasp the technical realities of quantum computing and Bitcoin’s security model. Let’s explore the facts.

Bitcoin’s Security: Layers of Defense

Bitcoin’s security relies on two primary cryptographic systems:

ECDSA (Elliptic Curve Digital Signature Algorithm):

This secures private keys, which authorize transactions. Breaking ECDSA with a quantum computer would require approximately 1,000,000 stable, error-free qubits—a number far beyond today’s quantum capabilities.SHA-256 Hashing:

Bitcoin’s mining process relies on SHA-256, a hashing algorithm that would require millions of qubits and perfect execution of Grover’s algorithm to compromise. Even then, the computational energy required would be astronomical.

To put this in perspective, Google’s Willow chip operates with only 105 qubits, which, while impressive, is orders of magnitude away from posing a realistic threat.

Quantum Computing’s Real Timeline

Quantum computing is still in its infancy. While the number of qubits has grown from 53 in 2019 to 105 in 2024, the leap to the 1.9 billion qubits necessary to break Bitcoin is not on the immediate horizon. Beyond just adding qubits, quantum computers must overcome significant challenges such as error correction, decoherence, and stable operation.

At the current rate of progress, humanity is more likely to colonize Mars than see a quantum computer capable of breaking Bitcoin’s encryption within the next decade.

Prepared for the Future: Bitcoin’s Upgrade Path

Bitcoin’s decentralized architecture is built with adaptability in mind. While quantum computing might eventually become a threat, the network has multiple avenues for upgrading its security:

Quantum-Resistant Cryptography:

Research has already identified viable replacements for Bitcoin’s current cryptographic algorithms, such as lattice-based and hash-based schemes (e.g., SPHINCS+ and Falcon).Upgrade Mechanisms:

Bitcoin can implement changes through a soft fork—a network upgrade that doesn’t disrupt backward compatibility. Historical examples, such as the 2021 Taproot upgrade, demonstrate the network’s ability to adapt when consensus is achieved.Consensus-Driven Governance:

Any change to Bitcoin requires overwhelming agreement across miners, node operators, and the user community. This decentralized process ensures that no single entity can force modifications, maintaining the integrity of the network.

Decentralized Governance: A Strength, Not a Weakness

Critics often misunderstand Bitcoin’s governance model, viewing its reliance on consensus as a limitation. In reality, this model is its greatest strength:

Consensus Is Key:

For any proposed change to take effect, over 90% of miners must signal agreement, followed by acceptance from nodes and adoption by users. This multi-layered process ensures any update has widespread support.No Central Authority:

Bitcoin’s developers, often referred to as the Core team, act as architects who propose solutions. However, they lack the power to enforce changes, control funds, or alter Bitcoin’s fixed supply of 21 million coins.Real-World Example:

The 2021 Taproot upgrade, which enhanced Bitcoin’s privacy and efficiency, required months of discussion, testing, and signaling before being implemented. Even after activation, nodes that chose not to upgrade continued to operate securely within the network.

Perspective: Bigger Threats Than Bitcoin

Quantum computing’s potential to disrupt industries is undeniable, but Bitcoin is far from the most vulnerable system. Banking networks, email encryption, government communications, and corporate data are far easier targets. These systems rely on centralized control and legacy encryption, making them more attractive to quantum threats.

Bitcoin, by contrast, is open-source, decentralized, and adaptable. Its community has already anticipated the quantum challenge and developed solutions that can be implemented well before the threat materializes.

The Real Danger: Centralization, Not Quantum

The sensationalism surrounding quantum computing and Bitcoin often distracts from the real issues. Bitcoin is not vulnerable because of technological flaws but because centralized powers—governments, corporations, and financial institutions—seek to control and undermine decentralized systems.

Bitcoin’s anti-fragility lies in its design. Its resilience comes not from immutability but from a global consensus model that empowers users rather than gatekeepers. True freedom lies in systems that cannot be captured, manipulated, or corrupted by centralized forces.

Sources

- Google Quantum AI: Latest advancements in quantum computing

- Bitcoin Core documentation on cryptographic upgrades

- National Institute of Standards and Technology (NIST): Quantum-resistant algorithms

- Historical Bitcoin upgrades, including the Taproot implementation

- Technical research on quantum computing and cryptographic vulnerabilities

Decentralized systems are the bulwark against a future dominated by centralized control. When the dust settles, the systems that empower individuals—not institutions—will define the next era of freedom. Bitcoin is not perfect, but it is the proof of concept that decentralization works. In the end, it’s not quantum computing we need to fear—it’s a world where no alternatives to centralization remain.