TL;DR: August 2023 has been a watershed month for the crypto industry, replete with significant events that have had far-reaching implications. From regulatory wins to Wall Street adoption, and from an ETF revolution to a surge in crypto mining, the stage is set for an accelerated path to mainstream adoption.

A Transformative Month for Crypto: August 2023’s Milestones

In a world obsessed with the immediacy of news cycles, it’s often easy to lose track of the forest for the trees. It’s vital, therefore, to step back and see the cumulative effect of individual happenings. And when it comes to August 2023, the crypto industry has seen a series of pivotal milestones that are worth exploring in depth.

Regulatory Approval: A Leap Toward Ubiquity

X Corp: Solidifying the ‘Everything App’ Vision

One of the largest hurdles for any emerging technology is the bureaucratic wall of regulations. The story of X Corp’s successful licensing in Rhode Island is more than a localized affair; it’s a case study of how crypto companies are increasingly weaving themselves into the very fabric of daily life. The vision of an ‘Everything App’ moves closer to realization as these regulatory shackles loosen.

Shifting Investment Paradigms

The Grayscale Effect: Transforming the ETF Landscape

Grayscale’s entrance into the ETF market marks a watershed moment in investment dynamics. By offering a more structured and mainstream investment vehicle, the door to institutional money is not just ajar; it’s swung wide open.

Legal Tides Turning: Coinbase & Ripple vs SEC

The legal friction between crypto firms and the SEC isn’t new. However, the legal defiance posed by Coinbase and Ripple marks a significant shift in the industry’s willingness to challenge bureaucratic inertia. No longer are crypto entities content to sit in regulatory purgatory; they’re taking the fight to the establishment.

Established Finance Enters the Ring

EDX Markets: Traditional Finance Embraces Crypto

Schwab and Fidelity’s move to launch EDX Markets reflects a broader shift in mainstream financial institutions’ attitudes towards cryptocurrency. They are no longer viewing it as a peripheral asset class but are starting to integrate it into their core services.

Wall Street Onboard: The Goldman and JPMorgan Effect

When Wall Street bellwethers like Goldman Sachs and JPMorgan embrace crypto, it’s hard to ignore the tidal wave of mainstream adoption that is likely to follow. Their involvement serves as a significant endorsement and will likely lower the resistance for other financial giants to take similar steps.

The Future of Finance: Strategic Interest and Innovations

BlackRock, WisdomTree, Invesco: The ETF Race

The decision by leading asset management firms to explore crypto ETFs is emblematic of how traditional finance is starting to realize the untapped potential of cryptocurrency. This move will likely precipitate a rush of financial innovation centered around crypto assets.

Mining Boom: Hut 8, Riot & Cleanspark’s Exponential Growth

The remarkable surge in the stock prices of crypto mining companies points to a broader trend: mining is becoming an increasingly viable industry, moving from the fringes into the mainstream limelight.

Other Noteworthy Developments

Record BTC Transactions and the Upcoming Halving

The sheer scale of Bitcoin transactions has set new records, indicative of its rising utility and acceptance. Additionally, the anticipation surrounding the 2024 Bitcoin halving is already creating bullish market sentiments.

Renewable Energy and Crypto: An Unlikely Alliance

Contrary to the narrative that crypto is an energy hog, there are indications that the industry is driving investments into renewable energy sectors. A ‘green’ crypto could very well be on the horizon.

In a world increasingly defined by centralized control, the transformative milestones reached in August 2023 are signs that the pendulum is swinging back toward the individual. The visions once confined to impassioned debates and libertarian manifestos are crystallizing into tangible structures. While each milestone is significant, collectively they signal a departure from a system that has long prioritized control over innovation, centralization over individual freedom.

Thank you for reading “A Transformative Month for Crypto: August 2023’s Milestones“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources:

- X is one step closer to crypto payments with Rhode Island

- Bitcoin ETF Approved for Grayscale by US Court

- Coinbase joins crypto supporters siding with Ripple in SEC case

- Charles Schwab, Citadel and Fidelity Launch EDX Crypto Exchange

- JPMorgan Sees More Crypto Adoption in 2022, Debates Bitcoin

- Bitcoin, Crypto Stocks Jump After US Court Paves Way for ETF

- Bitcoin Sets New All-Time Record for Daily Transactions

- How crypto mining will transform the energy industry

- How blockchain and cryptocurrency can create a greener future

Recent Stories

A Transformative Month for Crypto: August 2023’s Milestones

The vanguard of global commerce has been swept up in a wave of change, as over 62% of Fortune 100 companies…

Why Opposing CBDCs Means Supporting Bitcoin

TL;DR: Central bank digital currencies represent centralized control over money and surveillance of transactions….

Navigating the $16M Quicksand: How Crypto Scams and Hacks Devoured Millions in August

TL;DR: Understanding the multifaceted layers of scams, especially in the cryptocurrency sphere, is crucial…

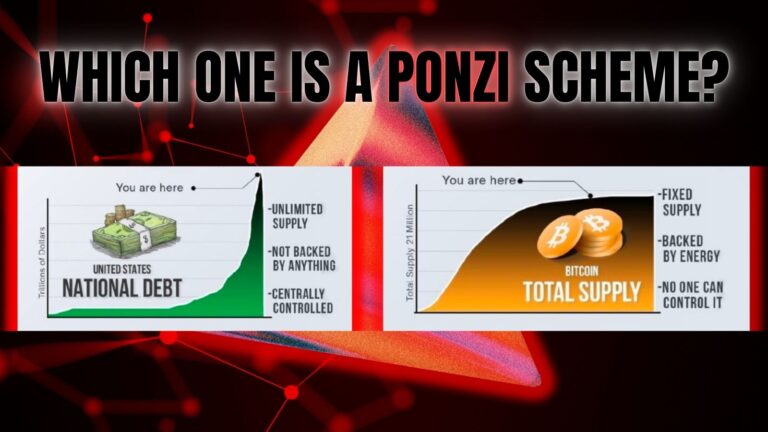

The Illusion of the Dollar: Is Fiat Currency the World’s Grandest Ponzi Scheme?

TL;DR: The article delves into the controversial claim that the U.S. dollar, and by extension all fiat…

No posts found