The Revolutionary Aspect of Bitcoin’s Monetary Policy

Bitcoin, a decentralized digital currency, is redefining our understanding of money. Conventional currencies, subject to inflation and the whims of governmental policies, are often unpredictable and unstable, causing a continuous dilution of value. Bitcoin’s unique, codified monetary policy counteracts these issues. Its supply is capped at 21 million, making it inherently scarce, which significantly contributes to its value as a store of economic energy.

This inbuilt scarcity is further amplified by Bitcoin’s difficulty adjustment mechanism, which incrementally increases the computational effort required to mine new Bitcoins, making it exponentially more challenging to generate additional supply over time. This attribute has made Bitcoin mining 50 trillion times harder since its inception, a testament to the ingenious design and foresight of its creator, Satoshi Nakamoto.

Commodities and Traditional Stores of Value

A popular medium for storing wealth is commodities like gold, which has been considered a reliable store of value for thousands of years. The issue with commodities as money, however, is their physical limitations and the continual increase in supply due to human ingenuity and technological advancements. Essentially, betting on a commodity as a store of wealth means betting against human intellect, which has proven time and again to be a losing proposition.

Bitcoin as Sound Money

In stark contrast, Bitcoin, as sound money, showcases a different natural frequency. Assets around the world each have their unique natural frequencies. For instance, oil has a low stock to flow ratio, while the Argentine peso is doubling in supply every couple of years. On the other hand, Bitcoin’s stock-to-flow ratio is continually rising, slowing down its natural frequency.

This characteristic makes Bitcoin a more stable store of economic energy. By 2036, the half-life of your economic energy stored in Bitcoin will be a thousand years, and by 2048, it will be 10,000 years.

The Compounding Power of Bitcoin

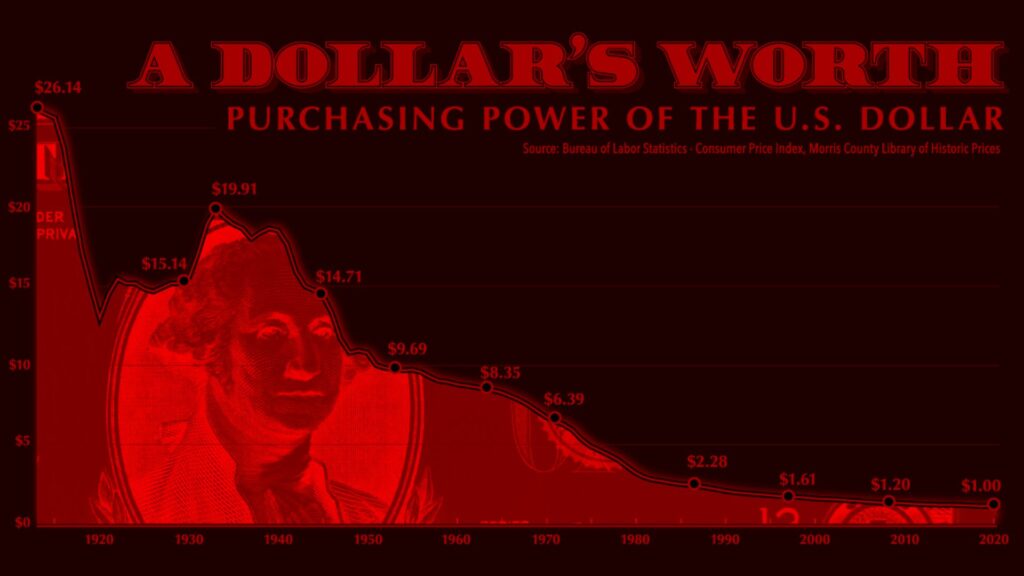

The beauty of this long-term store of wealth becomes evident when considered in the context of other assets and investments. For instance, holding a million dollars in cash, with a 7% annual inflation rate, will leave you with a mere $977 in today’s dollars after a hundred years. In contrast, flipping a million dollars into Bitcoin and holding it at a 7% real yield for a hundred years will turn you into a billionaire, a testament to the incredible power of compound interest and deflationary assets.

MicroStrategy, a significant player in the Bitcoin market, has seen incredible performance since entering Bitcoin, outperforming traditional asset classes like the S&P index, NASDAQ, gold, silver, and bonds. Bitcoin has shown its resilience and its superiority as a store of value in a volatile economic environment.

The Future of Bitcoin

The potential future of Bitcoin lies in its ability to demonetize other assets over time. It first targets gold, an asset that loses its value proposition in the face of Bitcoin’s digital scarcity. But as it continues its growth trajectory, it could further demonetize store-of-value assets like real estate, stock indices, and bonds. The resulting capital inflow into Bitcoin could trigger a dramatic increase in its value, providing a robust, deflationary asset that serves as the ultimate store of economic energy.

Bitcoin stands as a beacon of hope, a possible escape from the economic war that has seen individuals and organizations lose a significant portion of their wealth due to inflation. The strategy is clear: hold the best money.

Closing Thoughts

In the grand design of the cosmos, economic entropy is the natural order, reducing complex systems into chaos. As freedom-lovers, our task is not to resist this natural force, but to embrace it and seek refuge in a system that transcends the limitations of traditional fiat currencies. Bitcoin, with its revolutionary monetary policy and digital scarcity, offers a pathway to financial immortality.

By adopting Bitcoin as a store of economic energy, individuals and organizations can protect their wealth from the dilution and erosion caused by inflation. The decentralized nature of Bitcoin ensures that it is not subject to the whims of governmental policies, providing a level of stability and predictability that is sorely lacking in traditional monetary systems.

As the world awakens to the superior attributes of Bitcoin, we can anticipate a paradigm shift where other assets are gradually demonetized in favor of this digital currency. Bitcoin’s potential to outperform traditional store-of-value assets, as demonstrated by MicroStrategy’s remarkable success, showcases its ability to thrive in volatile economic environments.

In this age of economic uncertainty, it is crucial to have a robust strategy for preserving wealth. Bitcoin offers a winning strategy through its scarcity, resilience, and the compounding power of its deflationary nature. By holding Bitcoin, individuals can safeguard their economic energy for generations to come, transcending the limitations of traditional investments.

As we move forward, let us remember the words of the cypherpunk movement: “Privacy is necessary for an open society in the electronic age.” In the same spirit, let us recognize the importance of financial sovereignty and the power of Bitcoin to provide individuals with the means to control and protect their wealth. Embrace the revolution, hold the best money, and pave the way to a future of financial freedom.

Sources:

- Data on Bitcoin’s difficulty adjustment and scarcity: Lecture by Michael Saylor, CEO of MicroStrategy (Bitcoin for Corporations).

- Comparison of Bitcoin’s performance against traditional asset classes: MicroStrategy’s financial reports and market data.