TL;DR: Fidelity posed a seemingly simple question about new bill denominations to their X followers online. The overwhelmingly crypto-centric responses underscore the rising prominence of digital currencies in the modern financial landscape.

Fidelity’s Unexpected Feedback

In an era marked by technological evolution and financial transformation, even the most mundane questions can yield unexpected insights. When Fidelity inquired about a new bill denomination to its X online community, the response was overwhelmingly in favor of cryptocurrencies, reinforcing the notion of their growing significance in the global economy.

The Prompt and the Avalanche of Cryptocurrency Responses

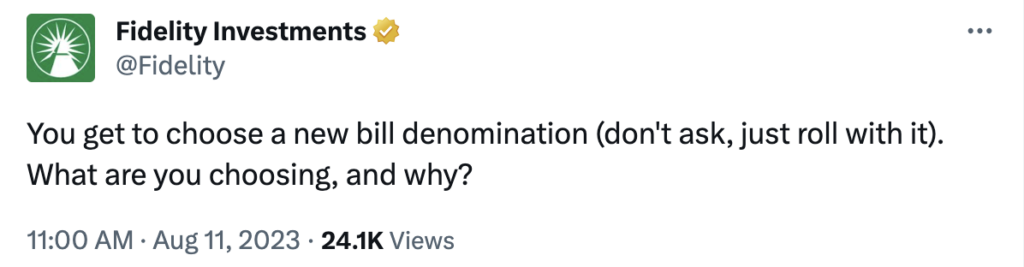

Fidelity’s query was straightforward:

You get to choose a new bill denomination (don’t ask, just roll with it). What are you choosing, and why?

However, the tidal wave of crypto-themed answers took many by surprise. Phrases like ‘$BTC’, ‘#DOGECOIN’, and ‘$Sats’ dominated the conversation, signaling a shift in popular sentiment towards digital assets. Even amidst traditional finance suggestions like a $200 or $1,000 bill, concerns about inflation and the diminishing power of the dollar were evident.

Cryptocurrency: A Beacon or a Mirage?

It’s easy to view these responses as mere banter, a reflection of the whimsical nature of online communities. Yet, beneath the surface, these replies indicate a deeper narrative. Traditional currencies, often regarded as stable and reliable, are now juxtaposed against the new kid on the block — cryptocurrencies. This new wave of digital assets is hailed for its decentralized, transparent, and empowering architecture, offering a glimpse into the future of finance. The concerns about volatility and regulations are just teething troubles in the grand journey of this financial revolution.

A Promising Horizon: Regulatory Embrace of Cryptocurrency ETFs

The horizon for cryptocurrency, particularly within regulatory boundaries, is filled with optimism. The financial sphere is abuzz with discussions about Bitcoin ETFs, with industry titans like BlackRock, Bitwise, VanEck, and Fidelity eagerly awaiting regulatory endorsements. While notable figures like former SEC chief, John Reed Stark, have voiced concerns, it’s crucial to remember that groundbreaking technologies often face early skepticism. In a bolstering development, the asset management behemoth AB Bernstein, which manages $779 billion, indicates a rising confidence in the approval of a spot Bitcoin ETF. As we’ve seen throughout history, initial skepticism often gives way to widespread adoption and integration.

Politics and the Path to Progressive Cryptocurrency Regulation

While the realm of crypto regulation has historically steered clear of partisan divides, the dynamic seems to be evolving. This change might well indicate that cryptocurrencies are moving from being a niche interest to a foundational pillar of financial and political discourse. The increasing attention from political entities can be seen as a testament to the growing significance and potential of digital assets in reshaping our economic future.

A Glimpse of the Future

Crypto Policy Should Be Forward-Looking

In a rapidly evolving world, it’s evident that traditional financial paradigms are being challenged. Digital assets, once the domain of the tech-savvy, are now mainstream. Institutions, governments, and individuals alike need to navigate this new landscape with caution, embracing the promise of a decentralized future while safeguarding against its inherent risks.

Thank you for reading “Fidelity’s Intriguing Question to the X Community: Cryptocurrency Takes Center Stage.”

- Subscribe to our newsletter: Consensus Protocol

- Follow us on Twitter: Twitter

Sources:

- Fidelity’s Official Twitter Account.

- Comments and insights from John Reed Stark, ex-chief of the SEC.

- Better Markets’ August 8, 2023, SEC Comment Letters.

- Historical references from corpgov.law.harvard.edu and linkedin.com related to the SEC’s stance on cryptocurrency.