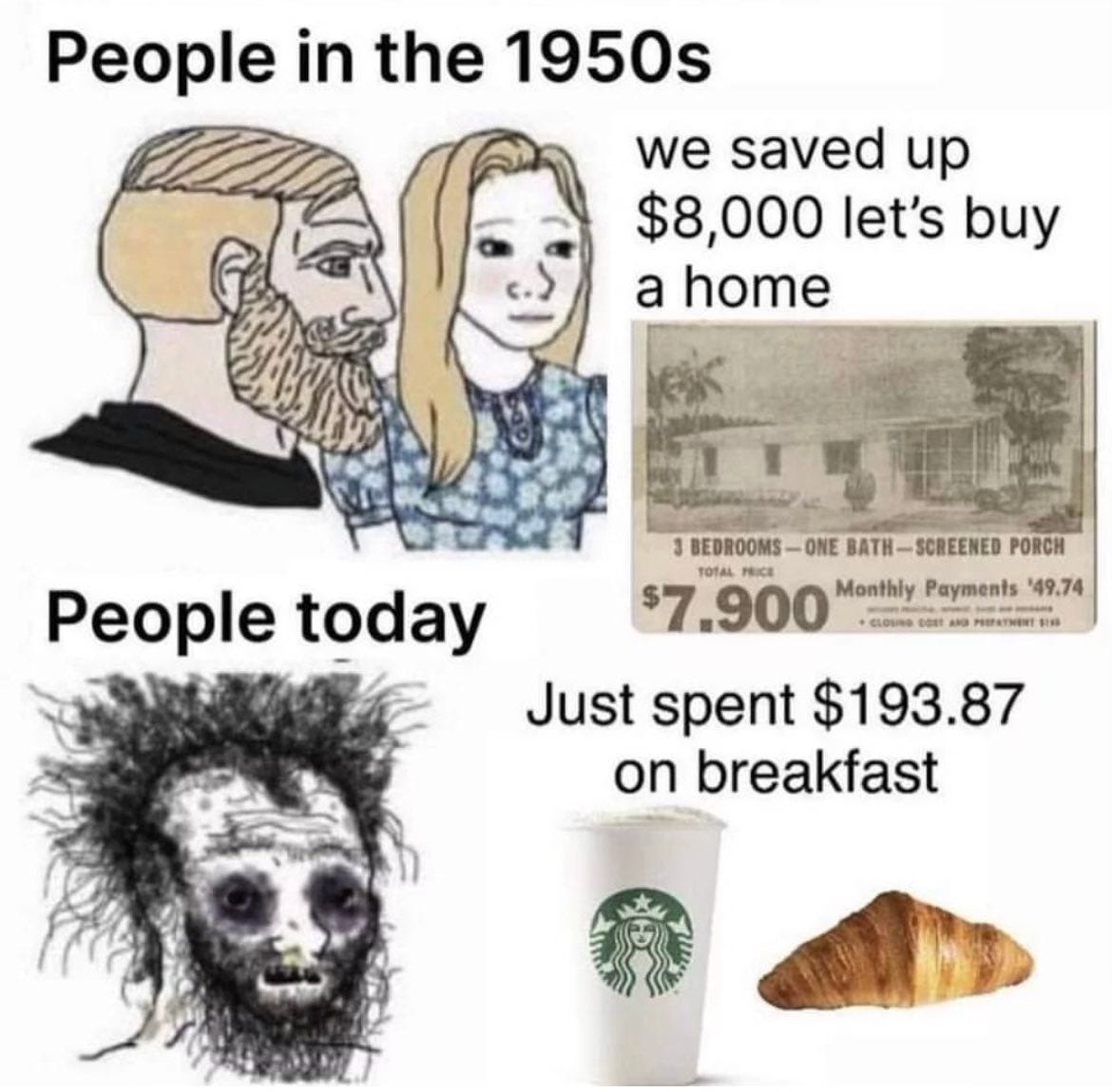

TL;DR: Inflation has eroded the purchasing power of money to the point where what once bought a house now barely covers your grocery bill. Amid this backdrop, Bitcoin emerges as an asset resistant to inflation, a digitized store of value that transcends borders and centralized control. This article delves into the transformative power of Bitcoin against the rising tides of inflation.

The Fallacy of ‘More Money, More Problems’

More money is flooding into the system than ever before, but it doesn’t seem to be solving anyone’s problems. Central banks around the world continue to print money at an unprecedented pace, diluting the value of hard-earned savings and widening the gap between the financial elite and the average citizen.

From Homeownership to Avocado Toast: A Tale of Shifting Affordability

There was a time in America when saving up $8,000 could land you a house. Fast forward to today, and that amount might not even cover the lease deposit in some cities. This isn’t just a “kids these days” situation or a “back in my day” rant. It’s a profound change in how money works, or rather, how it doesn’t.

Inflation: The Silent Thief

Inflation isn’t just an economic term; it’s a measure of the subtle theft of your financial future. It’s the erosion of purchasing power, where the dollar in your pocket buys less and less over time. Often, this theft is explained away as an economic necessity, an inevitable part of modern financial systems. But should it be?

Enter Bitcoin: The Anti-Inflationary Asset

In a landscape of increasing financial instability and dilution of money, Bitcoin makes its entrance. Born from the 2008 financial crisis as an answer to uncontrolled financial systems, Bitcoin operates on deflationary principles. There will only ever be 21 million Bitcoins, making it resistant to the whims of central banks and politicians. This cryptocurrency is not just a new asset class; it’s an entirely new way of thinking about what money can and should be.

The Global Stage: Beyond Borders and Politics

Bitcoin isn’t just an American phenomenon; it’s a global one. From protestors in Hong Kong to entrepreneurs in Africa, people are turning to Bitcoin as a universal store of value and medium of exchange. It transcends political and geographical borders, offering financial empowerment to those who choose to opt into this emergent economic system.

Why Trust in Decentralized Protocols

In a world that seems to oscillate between technological utopianism and dystopian realpolitik, there’s a lesson here. Trust in systems that are transparent, predictable, and verifiable by anyone. In the digital age, the ones holding the digital gold make the rules. This isn’t about overthrowing systems or establishing new kinds of leadership. It’s about democratizing access to financial security, a right that should be as fundamental as free speech.

Unlike fiat currency, which is subject to censorship and can be devalued at the whims of central authorities, Bitcoin operates on a fixed supply, offering a shield against both financial manipulation and constraints on freedom of expression. It’s immune to the hyperinflative trends that have eroded purchasing power and made a joke out of traditional savings. Bitcoin promises not a utopia, but code you can verify and a value you can trust. In embracing such decentralized, permissionless financial systems, perhaps the dream of acquiring lifelong assets like a home isn’t too far off.

In a world where the future seems to hold more $200 breakfasts than $8,000 homes, Bitcoin invites us to reset the equation, to redefine what wealth means for generations to come. So, let’s raise a toast — not of overpriced avocado toast, but of financial freedom — to the prospect of once again shopping for dream homes instead of breaking the bank over breakfast.

Thank you for reading “Forget the Dream Home, Can You Even Afford Breakfast?“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro