TL;DR: While taxation played an integral role in the evolution of societies, from the agricultural systems of ancient Egypt to modern American civilization, a careful examination reveals that unchecked taxation can erode a society’s vitality. Comparatively, ancient Egyptian slaves might’ve had it easier than today’s Americans.

Taxation: A Timeless Pillar of Civilization

Taxation isn’t a modern invention. It emerged in primitive societies as leaders needed support while governing, which left them little time for material production. As societies evolved, so did the complexity and intent behind taxation. By the time we look at ancient Egypt, a system was in place that seamlessly integrated the state, spirituality, and daily life.

Ancient Egypt: Taxation’s Double-Edged Sword

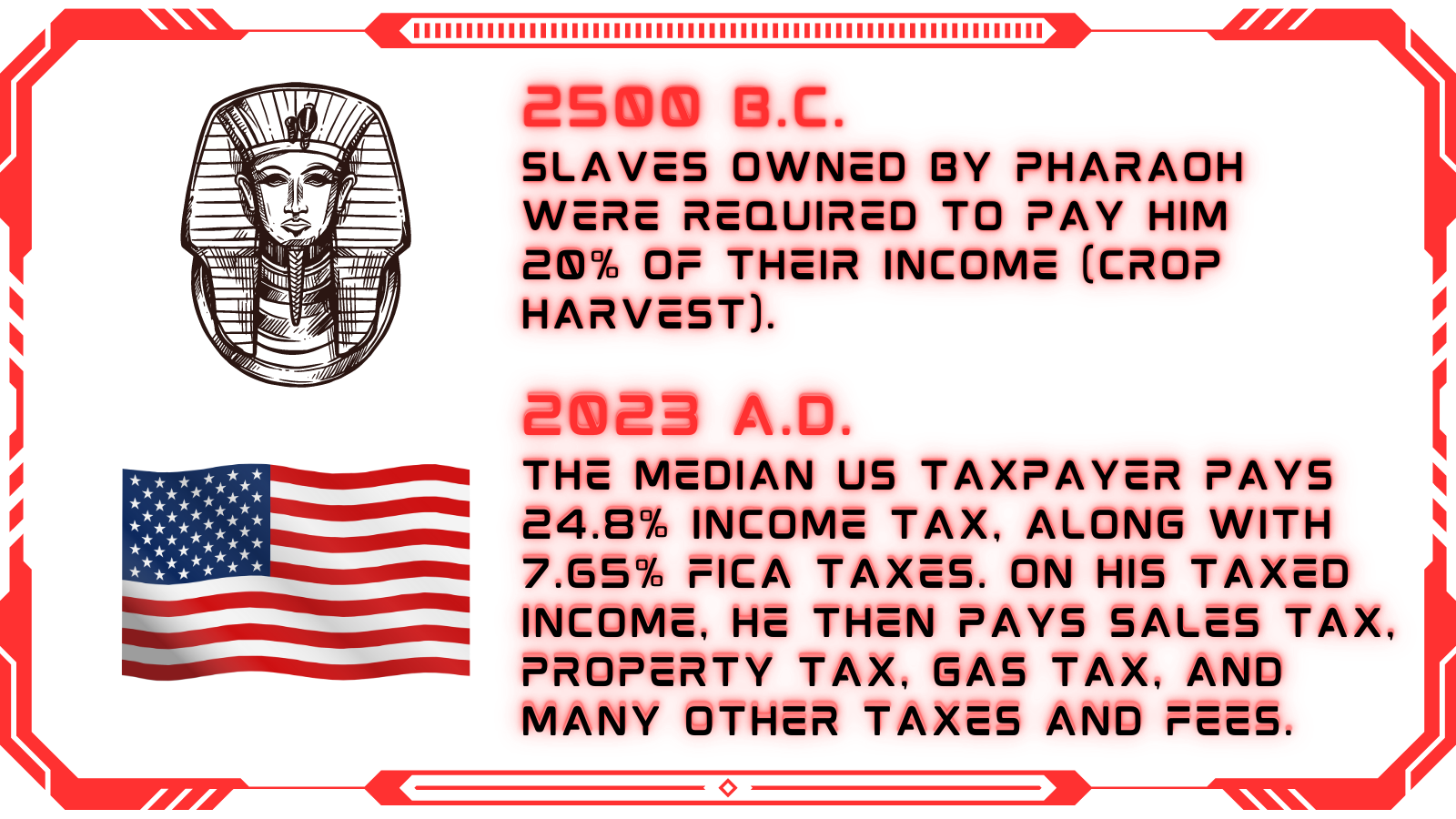

The Nile River valley’s agricultural systems required collective efforts. As communities stabilized and grew, they needed systems for management and distribution. Taxation began as tributes and offerings to leaders and deities. However, as time passed, these transformed into elaborate systems tied to land rights, property records, labor, and state resources. For reference, slaves owned by Pharaoh had to part with 20% of their income, a rate that seems almost lenient compared to today’s standards.

The Positive Outcomes of Taxation: Taxes in ancient Egypt were not merely a means of revenue collection. They professionalized government structures and incentivized record-keeping. The ancillary benefits were profound. The temple scribes, who doubled as tax record-keepers, pushed the boundaries in fields like astronomy, medicine, and mathematics. Moreover, writing itself owes a debt to tax documentation.

The Downsides: Yet, like any powerful tool, taxation had its perils. High taxes, especially when abused by officials, led to civil unrest. While the state occasionally attempted to quell these uprisings through tax amnesties, high rates remained a recurrent catalyst for societal discord. Over-reliance on taxation gradually weakened Egypt’s societal fabric.

Modern America: Echoes of the Past?

Fast forward to 2023, and we see the average American taxpayer parting with 24.8% of their income as tax, and that’s before considering other indirect taxes and fees. When placed against the backdrop of what Pharaoh’s slaves paid, the comparison is disconcerting.

A River of Lessons

Taxation, akin to the Nile, holds the power to nurture or destroy. While it can propel societies to greatness, unchecked taxation can erode the very foundations of these societies. It’s imperative to ensure that taxation systems prioritize the collective welfare, fortifying societal ties and fostering innovation.

Blockchain: Paving the Way for Tax Evolution

As discussions about the intricacies of taxation continue, emerging technologies like blockchain present opportunities to reshape tax administration. With attributes like security and transparency, blockchain can streamline tax processes, minimize costs, and fortify public trust.

Yet, the journey to fully integrate blockchain into tax systems requires careful navigation, prioritizing collaboration and strategic transitions rather than abrupt system overhauls.

Crafting the Future of Taxation

Today, we’re poised to blend historical lessons with modern technology’s promise. For taxation to truly serve society, a judicious approach is essential. While blockchain heralds a bright future, its integration hinges on cooperative efforts and visionary thinking.

Tax professionals and policymakers carry the responsibility to shape this future, ensuring a balance between revenue collection and societal harmony. A future built on innovation and understanding awaits.

Thank you for reading “From Pharaohs to Uncle Sam: Are Americans Taxed More Than Ancient Egyptian Slaves?“.

- Subscribe to our newsletter: Consensus Protocol

- Follow us on Twitter: Twitter

Sources: