![]() TL;DR: Recent multi-day bank deposit delays highlight how little control customers have over their own money. A decentralized system like Bitcoin offers an alternative where you remain fully in control.

TL;DR: Recent multi-day bank deposit delays highlight how little control customers have over their own money. A decentralized system like Bitcoin offers an alternative where you remain fully in control.

Frustration Boils As Big Banks Remain Delayed

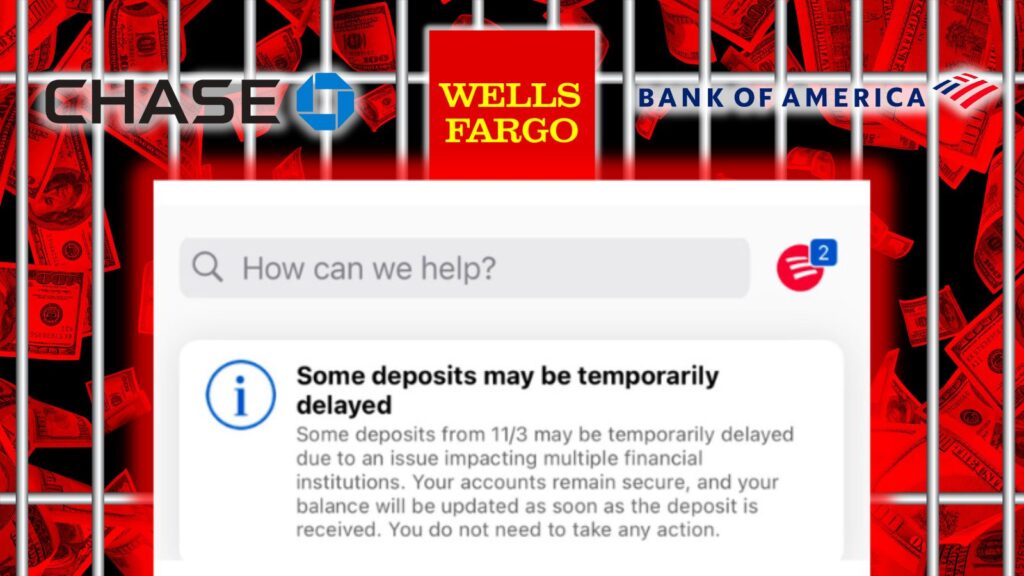

Major banks like Bank of America, Chase, and Wells Fargo faced outraged customers this week as deposit delays dragged on for days. A technical glitch disrupted direct deposits, paychecks, bills, and transfers, leaving accounts in limbo.

Understandably, affected customers vented their anxiety and frustration at being left helpless, unable to access their own hard-earned money. But the banks could only offer vague assurances and apologies, with little transparency on the issue or when it would be resolved.

This shocking incident lays bare an unsettling truth – the money in your bank account doesn’t really belong to you. Legally, it becomes the bank’s property upon deposit, and they have broad rights over your funds.

Banks’ Power Over Your Money

As a landmark court ruling confirmed, banks can debit customer accounts to pay debts without notice. Where you default on a loan or credit line, the bank can seize your checking or savings to cover it.

They only need to provide notice when the debit occurs. You have little recourse, as the court affirmed the bank’s “absolute right to setoff.” Your account balance belongs to the bank, not you.

This lack of control and transparency is bad enough normally. But deposit delays, tech failures, and liquidity issues can lock you out from your own money completely.

The Case for Decentralized Money

Bitcoin and crypto provide an alternative – decentralized money that puts you fully in control. Rather than relying on banks, your funds reside directly in your own digital wallet, secured cryptographically.

There’s no centralized body to decide if or when transfers go through. The decentralized network processes payments transparently per predefined rules. And your private keys give sole authority over your coins.

This returns real autonomy and self-sovereignty to users over their wealth. Just as the internet enabled free information, decentralized money enables free value transfer – without interference.

Of course, with greater control comes responsibility. Wallets must be secured diligently. But for those seeking true financial freedom, decentralized money is compelling.

The recent banking troubles demonstrate the flaws of the current system. In contrast, Bitcoin’s design provides an alternative where you control your financial destiny.

Thank you for reading “Frustration Mounts as Bank of America, Chase, and Wells Fargo Face Ongoing Deposit Delays: Is Bitcoin the Solution?”

.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources: