TL;DR

- Crypto carnage: In the past 24 hours, crypto traders saw over $150 million in liquidations, primarily driven by leveraged short positions.

- Bitcoin’s triumphant surge: Bitcoin (BTC) surpassed $31,000, inflicting $55 million in liquidations on short-sellers.

- Altcoins join the party: Alternative cryptocurrencies, or altcoins, such as Chainlink (LINK), Polygon (MATIC), and Polkadot (DOT), experienced 6% to 10% gains.

- A warning for shorters: Betting against Bitcoin in a bull market can be perilous, as evidenced by the recent liquidations.

A Wild Ride for Crypto Traders

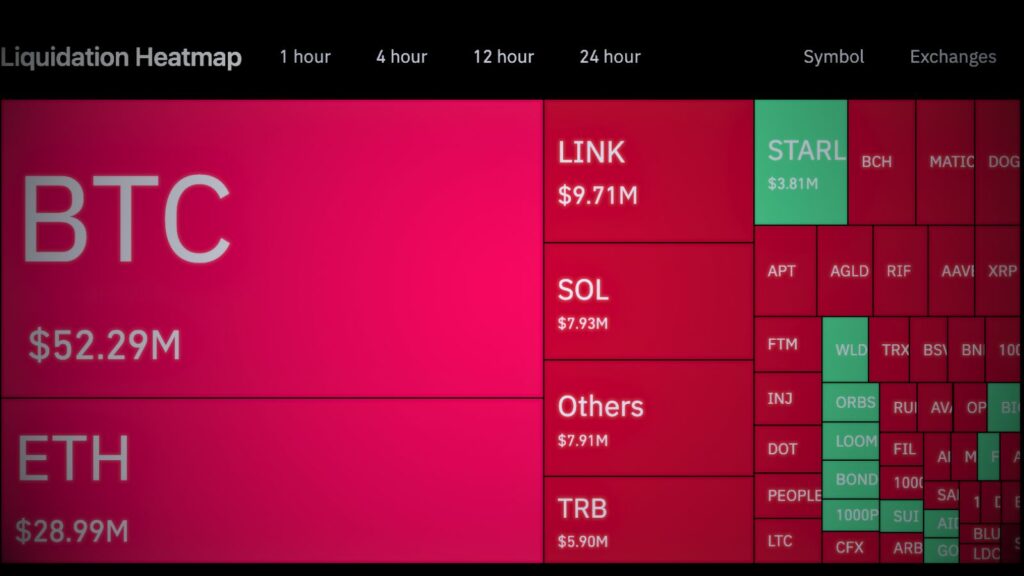

Crypto markets have been on a rollercoaster ride, leaving traders both exhilarated and bruised. In the past 24 hours, over $150 million in liquidations sent shockwaves through the crypto space, catching many leveraged traders off guard.

Most of the liquidations, totaling around $110 million, were short positions. These traders bet that crypto prices would fall, only to see their positions wiped out as prices surged.

Bitcoin traders took a substantial hit, with $55 million in liquidations, primarily affecting those who had shorted the king of cryptocurrencies. Ethereum (ETH) traders also felt the pain, losing roughly $29 million in liquidations. Even Chainlink (LINK) speculators suffered over $9 million in liquidations as LINK reached its highest price since May 2022.

The Bitcoin Rally and Altcoin Surge

This wave of liquidations coincided with Bitcoin’s impressive rally, surging 4% to break past the $31,000 mark for the first time since July. October had already seen Bitcoin’s price on the rise.

But it wasn’t just Bitcoin stealing the spotlight. Alternative cryptocurrencies, known as altcoins, joined the party. Chainlink’s LINK, Polygon (MATIC), and Polkadot (DOT) all posted substantial gains of 6% to 10%.

Liquidations: What You Need to Know

Liquidations occur when exchanges close leveraged trading positions due to traders failing to meet margin requirements or having insufficient funds to keep positions open. It’s a stark reminder that leverage amplifies both gains and losses in crypto trading.

Betting Against Bitcoin: A Risky Game

Attempting to short Bitcoin during a bull market can be a perilous gamble. The recent liquidations highlight the dangers of second-guessing Bitcoin’s direction, especially when it’s charging upward.

As the crypto market continues to evolve, traders must navigate its inherent volatility and unpredictable swings. One thing is certain: in the world of crypto, fortune favors the bold and punishes the overconfident.

Thank you for reading “Hodlers Rejoice as Bitcoin Liquidates $100M in Shorts“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources:

- Grayscale Court Victory Over SEC in Spot Bitcoin ETF Case Made Final (Source: CoinDesk)

- Grayscale Gets Court Order in Fight With SEC on Bitcoin ETF (Source: Bloomberg)

- Crypto Traders Suffer Over $100M of Short Liquidations as Bitcoin Hits 3-Month High Over $31K (Source: CoinGlass)

- Bitcoin plays shorters for fools as a surge to $30,950 liquidates a huge number of risky positions (Source: Cointelegraph)

- Dogecoin leads sudden altcoin gains (Source: Cointelegraph)