![]() TL;DR: The crypto and economic landscapes are at a pivotal crossroads as we approach 2024. With the U.S. potentially on the brink of a recession, the upcoming elections, and the Bitcoin halving on the horizon, the stage is set for significant movements in the crypto market. Bitcoin’s behavior has been notably cyclical, with periods of stability followed by sudden growth. Amidst economic uncertainty, Bitcoin’s decentralized nature and lack of counterparty risk present it as a potential safe haven, much like gold in the 1970s. The possibility of a U.S. recession could lead to financial stimulus, potentially benefiting Bitcoin. Additionally, the evolving role of banks in the crypto space could signal a new era of mainstream adoption and financial restructuring.

TL;DR: The crypto and economic landscapes are at a pivotal crossroads as we approach 2024. With the U.S. potentially on the brink of a recession, the upcoming elections, and the Bitcoin halving on the horizon, the stage is set for significant movements in the crypto market. Bitcoin’s behavior has been notably cyclical, with periods of stability followed by sudden growth. Amidst economic uncertainty, Bitcoin’s decentralized nature and lack of counterparty risk present it as a potential safe haven, much like gold in the 1970s. The possibility of a U.S. recession could lead to financial stimulus, potentially benefiting Bitcoin. Additionally, the evolving role of banks in the crypto space could signal a new era of mainstream adoption and financial restructuring.

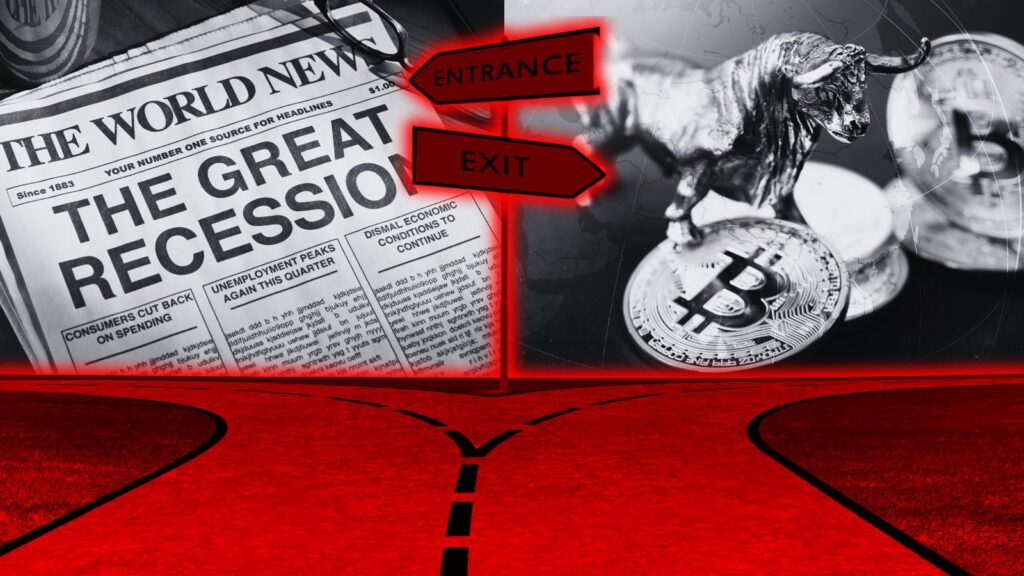

The Economic Stage and Bitcoin’s Potential Surge

The current economic indicators suggest a looming recession, with job growth at its lowest since January 2021 and unemployment rates on the rise. The political landscape is also heating up with the 2024 U.S. elections, where economic performance will be a key factor in voter decision-making. Amidst these developments, Bitcoin has been showing a pattern of stability with intermittent growth spurts, recently stabilizing around $34,000.

Bitcoin as a Hedge in Uncertain Times

Bitcoin’s resilience and decentralized nature have sparked discussions about its role as a hedge against both inflation and deflation. As traditional financial systems show signs of strain, Bitcoin’s lack of counterparty risk and transparent transactions become increasingly appealing.

The Global Economic Response

Countries around the world are responding to economic pressures with stimulus packages, which historically lead to inflation and could inadvertently boost the value of Bitcoin. The U.S. aid to Ukraine and the potential shift in funding priorities back to domestic issues also play into this complex economic tapestry.

The Banking Sector’s Crypto Conundrum

Banks are facing a new reality where their traditional business models are challenged by the rise of cryptocurrencies. The integration of crypto custody services by banks could be a pivotal moment for the industry, signaling a shift towards mainstream acceptance and potentially driving significant investment into Bitcoin.

The Road to 2024: A Crypto-Financial Nexus

As we approach the Bitcoin halving and the U.S. elections, the interplay between economic policy, financial stimulus, and crypto market dynamics will be critical. The potential for a spot Bitcoin ETF could catalyze institutional investment, while banks may seek to align with the growing crypto economy to stay relevant.

In the spirit of those who have always championed the sovereignty of the individual and the sanctity of personal liberty, the unfolding narrative around Bitcoin and the broader crypto ecosystem is more than a financial revolution; it’s a testament to the enduring quest for a system that serves the many rather than the few. As the traditional bastions of power grapple with the disruptive force of decentralized technology, the true value of Bitcoin may lie not just in its market price, but in its ability to redefine the very fabric of economic sovereignty.

Thank you for reading “Navigating the Economic Crossroads: How Recession Could Fuel Bitcoin’s Next Bull Run“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources:

- Job growth and unemployment data: U.S. Bureau of Labor Statistics

- Financial giant predicts this crypto price could rise 8,000% by 2030, here’s why

- Economic stimulus information: Government financial reports from the U.S., Japan, and China

- Bank restructuring and crypto custody: Financial industry publications and expert commentary