TL;DR: The Inflation Reduction Act, despite its promising name, has yet to make significant inroads in combating inflation. Meanwhile, Bitcoin’s design shows promise in offering a predictable hedge against inflationary pressures, with its limited supply and predetermined rate of production setting it apart from traditional fiat currencies. As governments worldwide struggle with inflation, there’s a growing sentiment favoring decentralized assets.

Inflation Reduction Act: Delving Beyond the Name

Despite its title, the IRA’s effects on inflation seem minimal so far. Proposed during soaring prices, the Act aimed to expand clean energy and American energy independence. However, inflation dropped from 9% to 3.2% largely independent of the IRA.

Most economists attribute the decrease to other factors:

- Declining oil and gasoline prices after 2022’s peak

- The Fed’s aggressive rate hikes reducing borrowing and demand

- Improving pandemic-disrupted supply chains

The Act’s focus was politics, not economics. Offering hope amid inflation, it now features centrally in Biden’s 2024 campaign. But its immediate impact looks overstated.

Long-Term Potential

The IRA holds some promise for the future. With the CHIPS Act, corporate investments in new factories have increased substantially. This influx might strengthen the job market against predicted recessions.

However, these benefits remain hypothetical. Quick fixes often fail to materialize. We must evaluate policies beyond rosy projections and politically expedient labels.

Inflation Reduction Act: An Elitist Approach?

A significant critique is that the immediate impact of the Inflation Reduction Act seems rather minimal, especially considering the immediate tax hikes it has spawned. There’s growing sentiment that the Act is more aligned with elite interests than genuinely offering economic relief to everyday citizens.

Cryptocurrencies: Not All Are Created Equal

While Bitcoin stands out with its 21 million cap, other cryptocurrencies like Ethereum employ different mechanisms such as token burning. Meme coins, on the other hand, may have vast, unrestrained supplies. With the rise of NFTs and their unique digital scarcity, the intrinsic “gold” value of each cryptocurrency needs a meticulous, individual assessment.

Rethinking Inflation Resistance

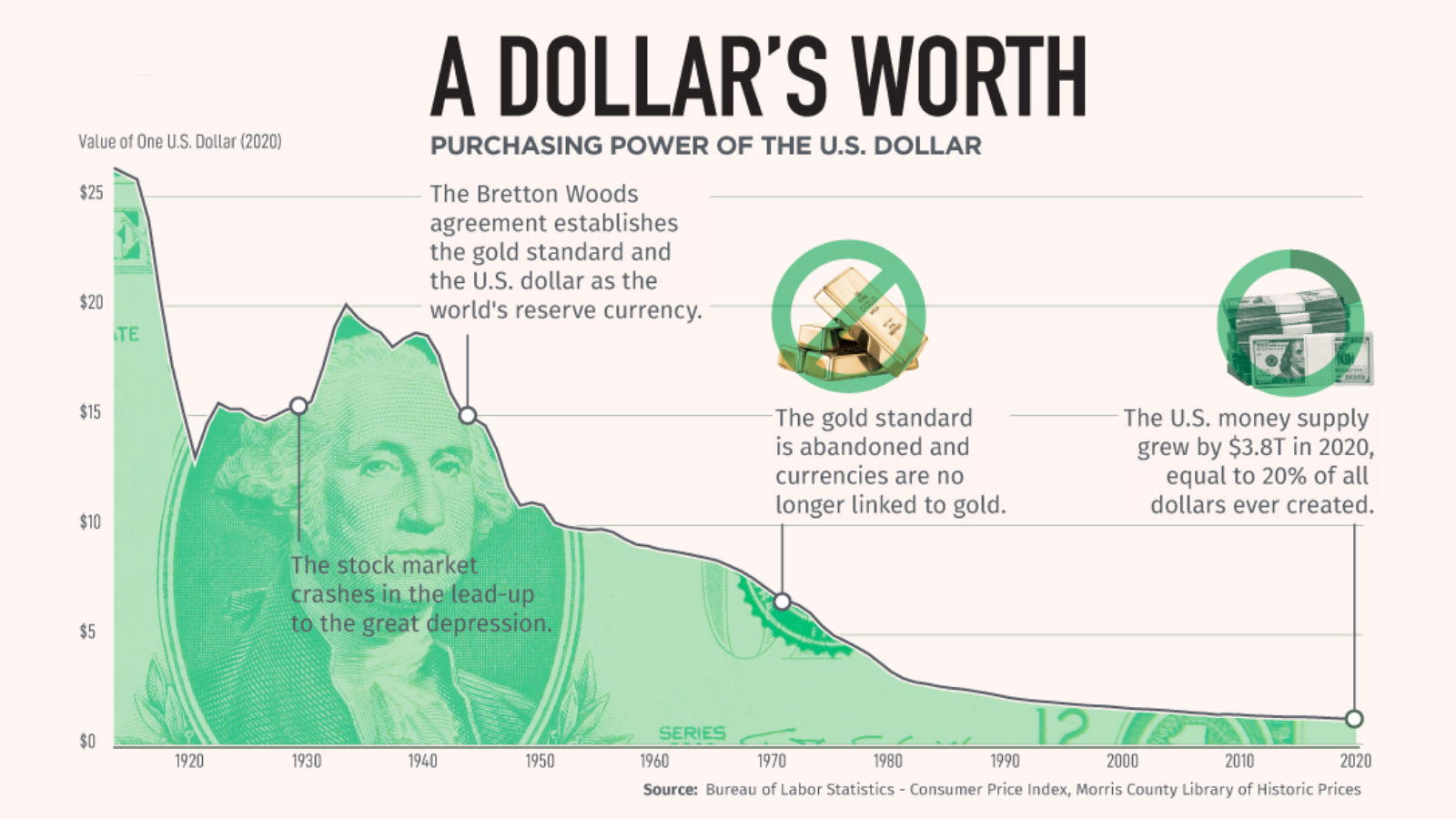

Perhaps solutions lie beyond traditional fiscal policy. Bitcoin’s design could offer more predictable inflation resistance than fiat currencies. Its limited supply and regular issuance provide concrete defenses against inflation’s uncertainty.

Unlike dollar inflation’s unpredictable whims, Bitcoin experiences systematically programmed inflation. And its digital scarcity ensures no sudden supply spikes like potential gold discoveries. Its transparent system and decentralized nature empower users to self-determine their financial future.

The Scarcity Advantage

We must thoughtfully explore all options to address inflation, not just short-term political patches. Lasting solutions require looking beyond the status quo to innovations like Bitcoin. Progress lies in open-minded exploration, not reflexive dismissal of alternatives.

The path forward demands pragmatic optimism untethered from stale conventions. We must shed outdated technocratic paternalism and embrace individual financial sovereignty.

Thank you for reading “The Inflation Reduction Act: Unfulfilled Hopes“.

- Subscribe to our newsletter: Consensus Protocol

- Follow us on Twitter: Twitter

Sources:

- Why bitcoin doesn’t seem to be a hedge against inflation — CNBC

- Inflation is down, but the Inflation Reduction Act likely doesn’t deserve the credit

- Joe Biden is staking his re-election on an economic policy called ‘Bidenomics’ that’s driving Republicans Crazy

- One Year Later, Inflation Reduction Act Implementation Remains … — Forbes

- Here’s Why Bitcoin Is a Good Inflation Hedge | The Motley Fool