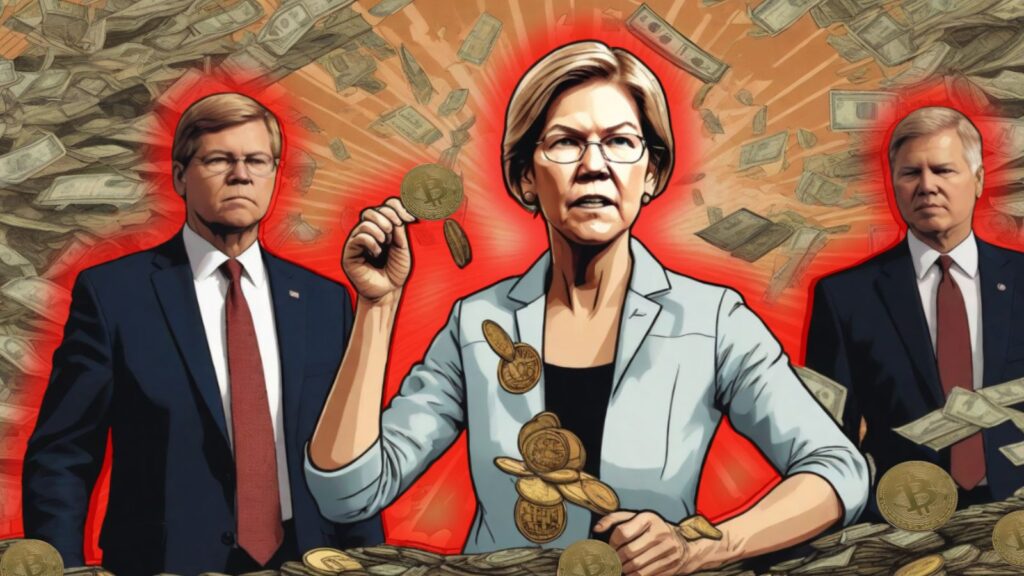

In the latest episode of the regulatory saga, Senator Elizabeth Warren has taken center stage, championing a call to ban private cryptocurrency wallets. This move has sparked intense debates within the crypto community, raising concerns about the potential erosion of individual financial autonomy.

Warren’s Stance: A Stricter Regulatory Approach

Senator Warren’s advocacy for banning private crypto wallets reflects a broader push for increased regulatory scrutiny in the cryptocurrency sphere. Her concerns revolve around potential illicit activities and the need for enhanced oversight to curb these activities. However, this approach has ignited a fierce backlash from crypto enthusiasts who argue that such measures infringe upon the core principles of decentralization and financial freedom.

The Keep Your Coins Act: A Counterbalance to Regulatory Pressures

In response to the growing wave of regulatory challenges, Senators Ted Budd and Bill Huizenga have introduced the “Keep Your Coins Act” and the “Self-Custody Protection Act,” respectively. These bills aim to safeguard the ability of individuals to self-custody their digital assets, countering Warren’s proposed restrictions. The Senators argue that empowering individuals to control their crypto holdings is crucial for preserving financial autonomy in an era of evolving regulations.

Protecting the Right to Self-Custody: The Essence of the Bills

The Keep Your Coins Act and the Self-Custody Protection Act pivot on a fundamental principle — the right of individuals to self-custody their digital assets. This right, they argue, is integral to the ethos of cryptocurrencies, emphasizing the need to strike a balance between regulatory oversight and the preservation of individual freedoms.

The Battle for Financial Autonomy: What’s at Stake?

At the heart of this debate lies a fundamental question: How much regulatory oversight is too much? While proponents argue that increased scrutiny is essential for combating illicit activities, opponents, including Senators Budd and Huizenga, stress the importance of protecting the individual’s right to financial privacy and autonomy.

Bitcoin’s Role: A Borderless Solution Amid Regulatory Turmoil

As the Senate grapples with these opposing viewpoints, Bitcoin emerges as a symbol of resilience and decentralization. In a landscape where money is at the center of a power struggle, Bitcoin’s borderless nature offers a unique solution. By providing a share in global productivity, it becomes a testament to the potential of decentralized currencies to transcend regulatory challenges and reshape the future of finance.

Closing Thoughts: Nurturing Financial Sovereignty

In the ongoing clash between regulatory oversight and individual financial freedom, Senators Warren, Budd, and Huizenga embody the broader struggle within the crypto community. The outcome of this legislative battle will undoubtedly shape the future of the crypto landscape. As we navigate these uncharted regulatory waters, the need to nurture financial sovereignty becomes increasingly apparent, reminding us of the core values that underpin the cryptocurrency movement.

Thank you for reading “The Senate Showdown: Elizabeth Warren vs. Crypto Wallets“.

- Subscribe to our newsletter: ConsensusProtocol.org

- Follow us on Twitter: @ConsensusPro

Sources: