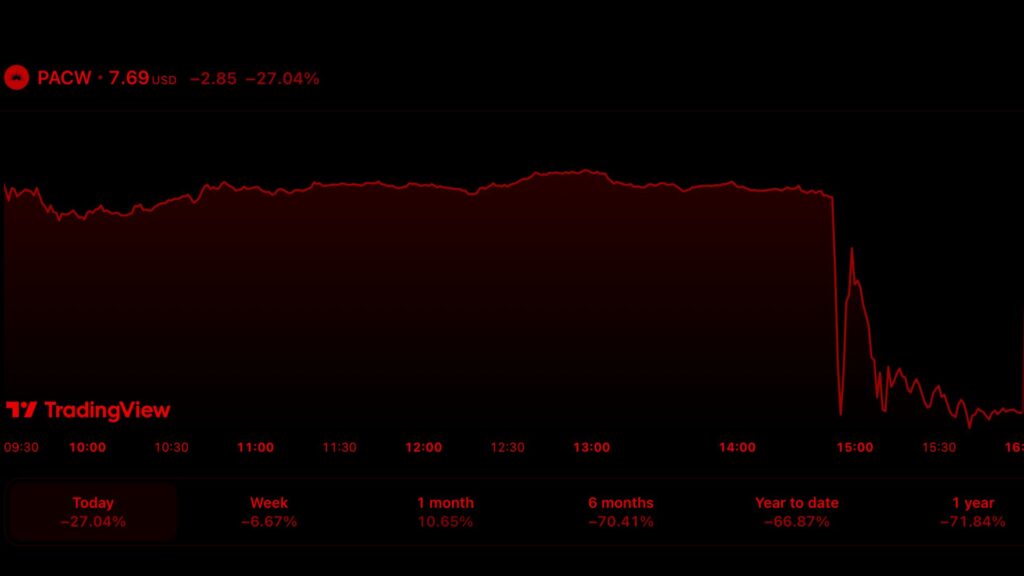

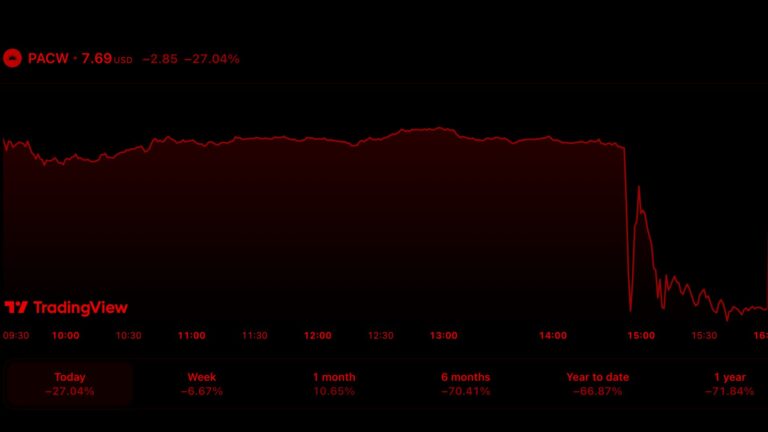

In the world of finance, the term ‘shitcoin’ is often thrown around to describe a cryptocurrency that holds no real value. However, in a surprising turn of events, it’s not a cryptocurrency that’s making headlines for a dramatic fall. Instead, it’s the $44 billion banking behemoth, PacWest Bancorp ($PACW), which saw a staggering 25% drop in value in a single day. The question on everyone’s lips is – are we on the brink of another banking crisis? Could the next rate hike be the final push that sends more banks tumbling over the precipice?

A Lifeline for PacWest Bancorp

PacWest Bancorp, a bank that narrowly avoided failure earlier this year, has been the subject of speculation for months. The future looked bleak, especially after the collapse of three other regional banks this spring. However, a lifeline has been thrown in the form of an all-stock transaction with Banc of California.

This deal, announced on a Tuesday, was made possible with the assistance of Warburg Pincus and Centerbridge Partners. These two private equity firms, known for their investments in distressed companies, are injecting $400 million to help restructure the balance sheet of the merged entity.

A Glimmer of Hope Amidst the Crisis

This acquisition is a ray of hope for PacWest, the parent company of Pacific Western Bank, and its shareholders. The bank’s stock had plummeted by nearly two-thirds this year due to fears that it could be the next to collapse, following in the footsteps of Silicon Valley Bank, First Republic, and Signature Bank.

PacWest’s business model, similar to that of First Republic Bank, involved serving affluent customers and offering favorable loans in exchange for deposits. However, this model became a liability when investors began hunting for other potential bank failures.

Like many regional banks, PacWest had billions of dollars in unrealized losses in its bond portfolio and uninsured deposits at risk of withdrawal at the first sign of trouble. To maintain investor confidence and prevent regulatory closure, PacWest had been offloading assets and businesses for several months. Despite these efforts, the stock still fell nearly 30% on Tuesday due to speculation of a fire sale acquisition.

The Dawn of a New Era

The $1 billion deal will result in a combined Banc of California-PacWest entity with $36 billion in assets and 70 branches throughout California. Warburg Pincus and Centerbridge will hold a 19% stake in the merged company, which will retain the Banc of California name, despite PacWest being the larger institution.

A Call to Arms

In the wake of these banking crises, Bitcoin has been experiencing record low volatility, hinting at a history-making move on the horizon. The trust in traditional banking institutions is wavering, and it might be time to consider alternatives. Bitcoin, a decentralized digital currency, offers a potential solution.

In the spirit of liberty and the pursuit of financial sovereignty, it’s time to take control of our financial future. The banking crises serve as a stark reminder of the inherent risks in centralized financial systems. It’s time to embrace the future of finance – a future that empowers individuals, not institutions.

Sources:

Recent Stories

The Unraveling of a Banking Giant: PacWest Bancorp

The vanguard of global commerce has been swept up in a wave of change, as over 62% of Fortune 100 companies…

The Genesis of Blockchain: From Bitcoin to a Global Phenomenon

The story of blockchain technology is one of innovation, disruption, and a relentless pursuit of decentralization….

Today’s Highlights From Within the Crypto World

In the realm of digital currencies, Bitcoin’s record low volatility signals a potential history-making…

Florida: A New Frontier for Bitcoin Mining

Florida’s regulatory climate and thriving energy sector make it a prime candidate for businesses,…

No posts found